Anatomy of Our Assessment: Affordability

This feature is a question-by-question analysis of our “Is it time to get help?” assessment, and how it helps families move forward and make deeper connections with our clients.

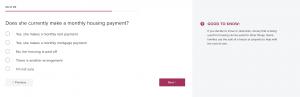

Today, we’ll take a closer look at Question 20.

With this question, we try to gently acknowledge a concern that’s often top of mind: “Can I afford senior living? And if so, how?” For many families, figuring out the finances can feel like the biggest mental hurdle in making a move into a senior living community.

Reorganize the Budget to Achieve Affordability

We think it’s important to recognize people’s real and practical concerns about affordability up front without pressing the issue too hard. We introduce the conversation about finances early with the goal of planting some seeds about how care might be made affordable by reconsidering expenditures and assets. For example, if in answering the question someone confirms that they are making monthly housing payments through rent or a mortgage, we can assume these resources are already allocated in the budget and could be used elsewhere. If they answer that the house is paid off, home equity loans or a house sale could support a desired lifestyle change. If someone says they live with their adult children or other relatives, a bit more exploration may be needed to get a better sense of the financial picture.

Different Financial Profiles Depending on Who Answers the Questions

Delving into survey data we’ve noticed that when someone explores care options for their mother, nearly half report that the house has been paid off and a quarter say their mother pays rent. However, when someone takes the assessment for themselves 33% say they own their house free and clear, 38% pay rent, 21% still have a mortgage payment. This could suggest that people research community options for themselves earlier in the decision-making process, for example, before they’ve paid off their homes. It could also point to how communities can support people by offering different types of financial educational resources either for the person themselves or for adult children looking into options for a parent.

Affordability: A Widely Shared Concern

A National Housing Partnership (NHP) Foundation survey found that among 1,000 prospective American retirees, aged 50 and up, respondents ranked affordability of retirement housing as their number one concern, with 60% saying that affordability was the greatest desire among retirement considerations.1 Given how many people share concerns about affordability, we think it’s a disservice to families to not talk about it. But of course, conversations about finances must be approached with tact, sensitivity, and recognition that the topic can provoke anxiety.

Start Discussing Options Early

With our assessment, we broach the topic of finances early with the aim of acknowledging the underlying concerns someone may have about money. We try to encourage families to start discussing options. In connecting families with care communities, financial fit is one of many key considerations. Even when a match is not made between a community and a family, some understanding of financial resources can be key to providing appropriate referrals or connecting a family with other resources or programs that may be well suited for their needs.

Sources

- The NHP Foundation. SURVEY: Boomers Unprepared for Looming Retirement Over one-third have no retirement budget. March 20, 2018. Available here. Accessed Dec. 3, 2019.

For more blogs that explore the thinking behind Roobrik assessment tool check out “23 Questions: The Science Behind the Survey,” and “Anatomy of Our Assessment: Getting Personal,” about “Anatomy of our Assessment: Let’s Talk.”